Peter Thiel is a name many folks know from PayPal or Facebook, but before all that, he actually spent a good chunk of time running a hedge fund. It’s a pretty interesting part of his story, especially how he got into it, what happened with his fund, and how it all shaped his later moves in the investment world. We’ll take a look at his journey, focusing on his experience with a peter thiel hedge fund.

Key Takeaways

Peter Thiel started exploring hedge funds even before PayPal took off.

Clarium Capital, Thiel’s hedge fund, grew pretty big but faced major problems during the 2008 financial crisis.

The fund’s performance sparked a lot of talk, with some saying it failed and others seeing it differently.

After Clarium, Thiel shifted his focus to venture capital, backing a bunch of well-known startups.

Thiel also started programs like the Thiel Fellowship to help young entrepreneurs and push new ideas forward.

Peter Thiel’s Early Ventures

Founding PayPal and Its Impact

Peter Thiel’s journey into the world of tech and finance began with PayPal. He recognized the potential for online payments early on, co-founding Confinity in 1998, which later became PayPal. This venture addressed a critical need in the burgeoning e-commerce landscape. Traditional payment methods were clunky and ill-suited for the internet, and PayPal offered a streamlined solution. The impact of PayPal was huge, paving the way for secure and efficient online transactions. It wasn’t just about the technology; it was about building trust in a new digital economy. The online payments system was revolutionary.

Initial Foray into Hedge Funds

Before his venture capital successes, Thiel dipped his toes into the world of hedge funds. After graduating from Stanford Law School, he didn’t immediately jump into tech. Instead, he launched Thiel Capital Management. It was a learning experience, to say the least. He raised $1 million from friends and family, showing early entrepreneurial spirit. One early investment, a web-based calendar project, didn’t pan out, but it provided valuable lessons. These early experiences shaped his investment philosophy and risk assessment strategies. It’s interesting to see how Thiel’s career path wasn’t a straight line, but rather a series of calculated risks and pivots.

Transition from PayPal to Clarium Capital

The sale of PayPal to eBay in 2002 marked a turning point for Thiel. With the capital gained, he transitioned from being a tech entrepreneur to a hedge fund manager. This move led to the creation of Clarium Capital, a global macro hedge fund. It was a bold step, shifting from the fast-paced world of Silicon Valley startups to the more traditional, yet equally competitive, world of finance. This transition showcased Thiel’s ambition and his belief in applying his analytical skills to different markets. It’s a testament to his adaptability and willingness to explore new challenges. He was ready to tackle the global macro landscape.

Thiel’s early career was characterized by a willingness to take risks and learn from both successes and failures. His experiences at PayPal and his initial foray into hedge funds laid the groundwork for his later ventures in venture capital and technology investment.

Clarium Capital’s Formation and Growth

Establishing a Global Macro Hedge Fund

In 2002, Peter Thiel, already known for co-founding PayPal, established Clarium Capital Management with the goal of creating a global macro hedge fund. Unlike many funds, Clarium’s structure was unique, opting for a 0% management fee coupled with a 25% performance fee. This approach signaled a strong alignment of interests with investors, as Clarium would only profit if the fund generated positive returns. The firm aimed to capitalize on macroeconomic trends and global events to generate profits, setting it apart from traditional investment strategies.

Accumulation of Assets Under Management

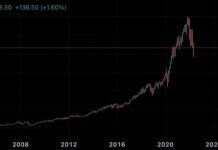

Clarium Capital experienced significant growth in its early years. By 2008, the fund’s assets under management (AUM) had ballooned to approximately $8 billion. This rapid accumulation of assets reflected investor confidence in Thiel’s vision and the fund’s investment strategy. The fund’s success was fueled, in part, by a prescient analysis of the petrodollar system, which anticipated a decline in oil supplies. This insight allowed Clarium to achieve a remarkable 40.3% return in 2007, further attracting investors and boosting its AUM.

Investment Philosophy and Strategy

Clarium Capital’s investment philosophy centered around a global macro strategy, which involved analyzing broad economic and political trends to identify investment opportunities. The fund invested across various asset classes, including public equity (with a focus on micro-cap companies), fixed income, and hedging markets. Clarium’s approach was research-intensive, relying on in-depth analysis of macroeconomic factors to make informed investment decisions. The firm’s early success was attributed to its ability to anticipate and capitalize on major global trends, such as the impending decline in oil supplies.

Clarium’s strategy involved taking positions based on predictions about currency fluctuations, interest rate changes, and commodity price movements. The fund’s investment decisions were driven by a combination of quantitative analysis and qualitative judgment, reflecting Thiel’s intellectual approach to investing.

Challenges Faced by Clarium Capital

Clarium Capital, despite its initial success and Peter Thiel’s reputation, encountered significant hurdles that ultimately led to a decline in its assets and influence. The confluence of economic downturns, strategic missteps, and investor reactions created a challenging environment for the fund.

Impact of the 2008 Financial Crisis

The 2008 financial crisis had a profound impact on Clarium Capital. Like many investment firms, Clarium experienced substantial losses as markets plummeted. The fund’s global macro strategy, which involved making bets on broad economic trends, was particularly vulnerable to the rapid and unpredictable shifts in the global economy. The credit crunch made it harder to invest in private companies, and the value of many of Clarium’s holdings dropped sharply.

Significant Investor Withdrawals

Following the financial crisis, Clarium faced a wave of investor withdrawals. Disappointed with the fund’s performance, many key investors pulled out their capital, further exacerbating the firm’s financial difficulties. By 2011, assets had dwindled significantly, reflecting a loss of confidence in Clarium’s ability to generate returns. The firm’s inability to capitalize on the economic rebound further fueled these withdrawals.

Decline in Assets Under Management

The combination of investment losses and investor withdrawals resulted in a dramatic decline in Clarium Capital’s assets under management. From a peak of over $8 billion in 2008, assets plummeted to around $350 million by 2011. This sharp reduction in scale severely limited the fund’s ability to execute its investment strategy and generate profits. The decline in assets also made it more difficult to attract new investors, creating a negative feedback loop.

The rapid decline in assets under management raised questions about the fund’s risk management practices and its ability to adapt to changing market conditions. While some analysts argue that Thiel foresaw the economic downturn, the fund’s performance during and after the crisis suggests that it was not adequately prepared for the severity of the market turmoil.

Here’s a summary of the asset decline:

2008 (Peak): Over $8 billion

2010: Significant losses, nearly 90% of key investors withdrew

2011: Approximately $350 million

Analyzing Clarium Capital’s Performance

Debates on the Fund’s Overall Success

Clarium Capital’s journey is a complex one, marked by both impressive gains and significant setbacks. Initially, the fund showed promise, attracting considerable assets under management. However, its performance became a subject of debate, especially after the 2008 financial crisis. Some argue that Clarium’s investment strategies, while innovative, were ultimately too risky for the prevailing market conditions. Others suggest that the fund’s focus on long-term, contrarian bets required more patience than many investors were willing to give. The fund’s inability to sustain its early success raises questions about its overall investment approach and risk management.

Perspective on Capital Management

Clarium Capital operated with a unique fee structure, foregoing the standard management fee in favor of a higher performance fee. This model aligned the fund’s interests more closely with those of its investors, but it also placed greater pressure on generating substantial returns. The fund’s capital management strategy involved investments in public equity, fixed income, and hedging markets, with a particular emphasis on global macro trends. However, the fund’s concentrated bets and lack of diversification may have contributed to its volatile performance. Here’s a brief overview of key financial events:

2002: Clarium Capital is founded.

2008: Assets peak at approximately $8 billion.

2011: Assets decline to around $350 million.

Market Conditions and Their Influence

Market conditions played a significant role in shaping Clarium Capital’s trajectory. The fund’s early success coincided with a period of relative stability and growth in the global economy. However, the 2008 financial crisis and subsequent market volatility exposed vulnerabilities in Clarium’s investment strategy. The fund’s focus on predicting long-term trends, such as the decline in oil supplies, proved challenging to execute in the face of short-term market fluctuations. The private equity returns were not as expected. Ultimately, the fund’s performance was heavily influenced by its ability to navigate these complex and unpredictable market dynamics.

It’s important to remember that hedge fund performance is not solely determined by the skill of the fund managers. External factors, such as economic conditions, regulatory changes, and investor sentiment, can all have a significant impact on a fund’s returns. Understanding these factors is crucial for evaluating the true performance of any investment fund.

Peter Thiel’s Post-Clarium Investment Focus

After the challenges faced by Clarium Capital, Peter Thiel strategically shifted his focus towards venture capital, marking a significant transition in his investment career. This move allowed him to concentrate on early-stage companies with high growth potential, leveraging his experience and insights gained from both PayPal and his hedge fund endeavors. It’s a story of adaptation and renewed vision.

Shift Towards Venture Capital

Thiel’s shift to venture capital was a calculated move, allowing him to invest directly in innovative companies and technologies. This approach differed significantly from the more liquid and directional strategies employed at Clarium Capital. He recognized the potential for outsized returns by identifying and supporting disruptive startups. This transition involved a more hands-on approach, working closely with founders and providing strategic guidance.

Founders Fund and Key Investments

Thiel co-founded Founders Fund, a venture capital firm that invests in companies building revolutionary technologies. The firm’s investment philosophy centers around supporting entrepreneurs who are tackling difficult problems and creating long-term value. Founders Fund has become a prominent player in the venture capital landscape, known for its contrarian bets and willingness to invest in unconventional ideas. They are known for their bold moves.

Early Funding in Prominent Startups

Peter Thiel’s early investments in companies like Facebook and SpaceX demonstrated his ability to identify and support transformative businesses. These investments not only generated substantial financial returns but also solidified his reputation as a visionary investor. His early bet on Facebook, in particular, is often cited as a prime example of his investment acumen. He saw something others didn’t. These prominent startups have changed the world.

Thiel’s post-Clarium focus reflects a broader trend in the investment world, where venture capital has become increasingly influential in shaping technological innovation and economic growth. His ability to adapt and identify new opportunities has been key to his continued success.

The Thiel Fellowship and Foundation

Peter Thiel’s influence extends beyond the world of finance and into the realm of fostering innovation and supporting young talent. Through the Thiel Foundation, he has established programs designed to challenge conventional thinking and encourage ambitious projects.

Supporting Young Entrepreneurs

The Thiel Fellowship, established in 2010, is perhaps the most well-known initiative. It offers $100,000 to young people under 23 who choose to leave college and pursue their own ventures. The idea is that traditional education isn’t always the best path for everyone, and some individuals thrive by diving directly into their passions. It’s a pretty radical idea, but it has definitely gotten people talking. The fellowship aims to provide resources and a network for these young innovators to develop their ideas without the constraints of a traditional academic environment. It’s not just about the money; it’s about creating a community of like-minded individuals. The Thiel Fellowship is a unique program.

Advancing Technological Progress

Beyond the Fellowship, the Thiel Foundation supports various initiatives aimed at advancing technological progress. This includes funding research into areas like artificial intelligence and life extension. The goal is to support projects that have the potential to significantly impact the future, even if they are considered high-risk or unconventional. It’s about pushing the boundaries of what’s possible and investing in ideas that could change the world. Breakout Labs is another grant-making body of the Thiel Foundation.

Promoting Long-Term Thinking

Thiel’s philanthropic efforts often emphasize long-term thinking. He encourages individuals and organizations to consider the big picture and to focus on projects that have the potential to create lasting value. This perspective is reflected in the types of projects the Foundation supports, which often address fundamental challenges facing society. It’s not just about short-term gains; it’s about building a better future. He is a conservative libertarian.

Thiel’s commitment to long-term thinking is evident in his support for projects that address fundamental challenges facing society. He believes in investing in ideas that have the potential to create lasting value, even if they are considered high-risk or unconventional.

Peter Thiel’s Broader Influence

Peter Thiel’s impact extends far beyond his ventures in finance and technology. He has become a notable figure in various spheres, influencing discussions on innovation, politics, and society. His views, often contrarian, have sparked debate and shaped perspectives in Silicon Valley and beyond.

Role as an Entrepreneur and Investor

Thiel’s entrepreneurial journey, starting with PayPal, has made him a role model for aspiring founders. His early investments in companies like Facebook and LinkedIn have solidified his reputation as a keen investor with a knack for identifying promising startups. His investment philosophy often centers on backing companies with the potential to disrupt existing industries and create new markets.

Authorship and Thought Leadership

Thiel’s book, Zero to One: Notes on Startups, or How to Build the Future, has become a must-read for entrepreneurs. It presents his unique perspective on innovation and competition, challenging conventional wisdom and encouraging readers to think critically about the future. His writings and public appearances often touch on topics such as technological progress, government regulation, and the importance of long-term thinking. He is a thought leader, and his ideas are widely discussed and debated.

Contributions to Silicon Valley

Peter Thiel has significantly shaped Silicon Valley’s landscape. His support for young entrepreneurs through the Thiel Fellowship and his investments in numerous startups have helped to fuel innovation and create jobs. He has also been a vocal advocate for policies that he believes will promote technological advancement and economic growth. His influence extends to the culture of Silicon Valley, where his ideas on competition, innovation, and the future are widely discussed and debated.

Thiel’s impact on Silicon Valley is undeniable. He has not only invested in successful companies but has also fostered a culture of innovation and long-term thinking. His contributions have helped to shape the direction of the tech industry and have inspired a new generation of entrepreneurs.

Here are some of his contributions:

Early investments in successful startups

Founding the Thiel Fellowship to support young entrepreneurs

Advocating for policies that promote technological advancement

Conclusion

So, what’s the takeaway from Peter Thiel’s time with Clarium Capital? It’s pretty clear that even smart people with good ideas can hit rough patches. The financial crisis was a big deal, and it showed how quickly things can change, even for a fund that seemed to be doing well. While some might call it a failure, others see it as a learning experience in a tough market. Ultimately, it just goes to show that the world of finance is always moving, and there are no guarantees, no matter who you are.

Frequently Asked Questions

What are some of Peter Thiel’s most famous achievements?

Peter Thiel helped start PayPal, was its main boss, and later sold it. He also put the very first money into Facebook and helped create Palantir Technologies.

What was Clarium Capital?

Clarium Capital was Peter Thiel’s hedge fund. It invested in many different things around the world, trying to make money from big economic changes.

How did Clarium Capital perform?

Clarium Capital grew a lot, getting over $8 billion from investors. But then, during the 2008 money crisis, it lost a lot of money and many investors pulled their funds out.

What did Peter Thiel do after Clarium Capital?

After Clarium Capital, Peter Thiel focused more on venture capital, which means investing in new, growing companies. He started Founders Fund and put money into companies like SpaceX and Airbnb.

What are the Thiel Fellowship and Foundation?

The Thiel Fellowship helps young people who want to start their own businesses instead of going to college. The Thiel Foundation tries to make new technologies and encourages people to think about the future.

How has Peter Thiel influenced the world?

Peter Thiel is a big name in Silicon Valley. He’s known for starting companies, investing in others, and sharing his ideas through books and talks.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.